Under the trend of cultural tourism and performing arts, the watershed between government and commercial audio selection

01 Overview of the Global Professional Audio Market

According to analysis by relevant industry research institutions, the global professional audio market has maintained stable growth in recent years, with the cultural tourism and performing arts sector accounting for an important share, and government public projects accounting for about 20% -25%. The popularity of immersive audio technology, such as Dolby Atmos, is driving the demand for high-end devices, especially in scenes such as theme parks and theaters, forming a trend of technological upgrades.

It is worth noting that "immersive audio" technology is becoming a new choice in the field of cultural tourism and entertainment, bringing unprecedented auditory experiences to audiences. The popularization of this technology not only drives the demand for high-end audio equipment, but also provides a breakthrough for brands in technological innovation.

02 The difference between government and commercial projects

The differences in sound system selection between government projects and commercial clients are mainly reflected in procurement objectives, priority of technical indicators, and budget allocation.

1. Different procurement objectives

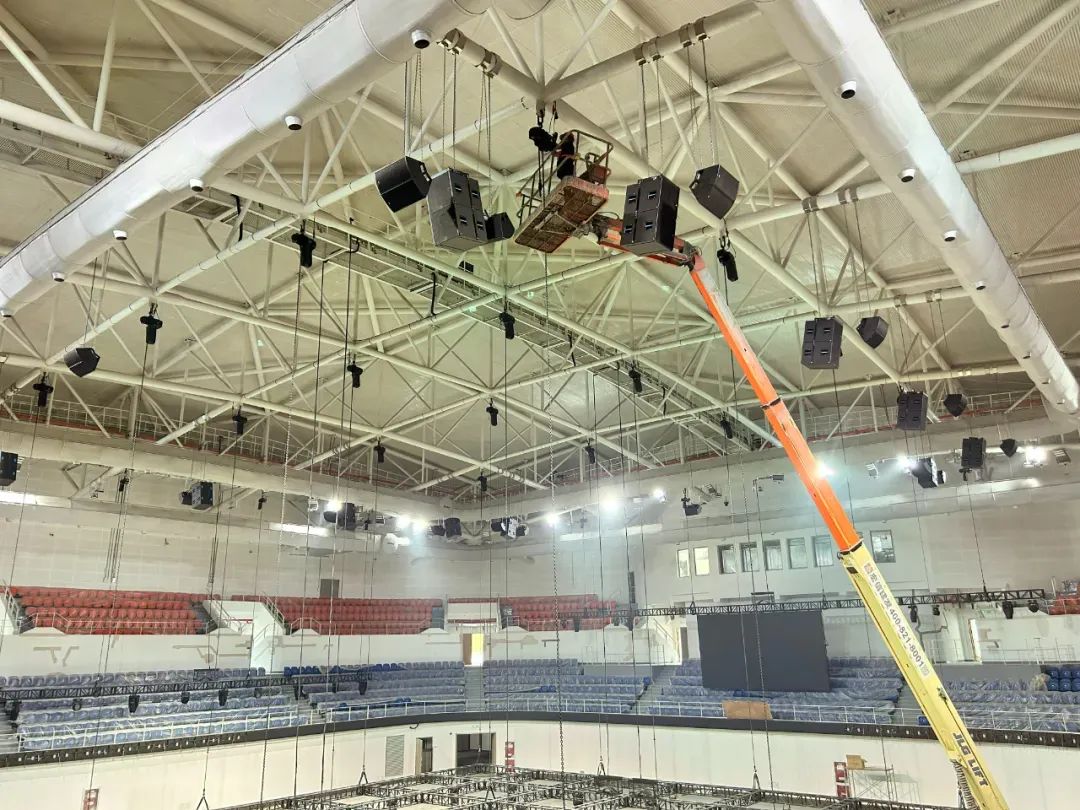

Government project: With public cultural services as the core, emphasizing universal coverage and durability. The project cycle is relatively long (1-3 years), with a stable budget and a higher proportion. For example, urban cultural centers tend to prioritize "one-time high specification construction" and choose fixed installation systems to ensure long-term maintenance free.

Business customers: profit oriented, focusing on user experience and brand premium. The project cycle is relatively short (3-12 months), the budget is flexible, and the proportion is relatively low. For example, commercial venues such as LiveHouse tend to prefer modular upgrades to quickly adjust equipment to meet different performance needs.

2. Priority of technical indicators

Government project: The sound quality requirement is mainly focused on clarity, and durability needs to adapt to extreme environments (such as moisture-proof and shockproof outdoor squares). Brand preference for localized service providers to ensure long-term maintenance and technical support.

Business customers: More emphasis is placed on immersion and bass performance, with short-term high load operation capability being key. Brand selection tends to favor international big brands to enhance venue quality and market competitiveness.

3. Data support

According to the AVIXA 2023 report, government projects have a significantly higher budget share for sound systems than commercial projects. In addition, commercial customers are more inclined towards leasing models (such as modular audio equipment for music festivals), while government projects focus more on one-time high specification construction.

03 Key factors in procurement decision-making

The three core indicators of professional audio

Sound pressure level (SPL): determines the coverage range of the sound system. Theater requires ≥ 110dB, outdoor plaza requires ≥ 120dB.

Frequency response range: The audible range of the human ear is 20Hz-20kHz, and entertainment audio systems need to cover the entire frequency band.

Directional control: Avoid echo interference. Government conference halls require narrow angle coverage, while concerts require wide angle diffusion.